Bitcoin is once again in the spotlight, trading just 4% below its all-time high as a wave of institutional investment and regulatory developments fuel optimism in the crypto market. The recent surge is driven by robust inflows into US-listed spot Bitcoin ETFs, which have recorded a 12-day streak of net positive inflows, signaling renewed confidence from both institutional and corporate investors .

ETF Inflows Signal Institutional Confidence

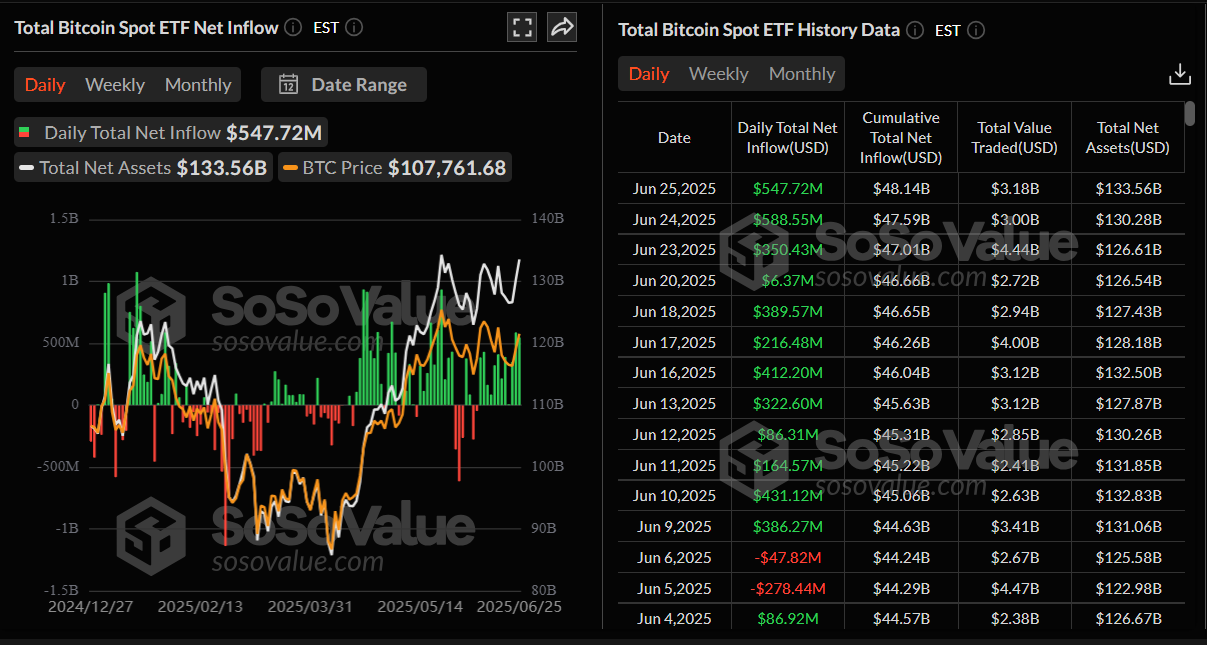

Over the past 12 days, spot Bitcoin ETFs have attracted nearly $4 billion in net inflows, with more than $547 million added on Wednesday alone . BlackRock’s iShares Bitcoin Trust ETF (IBIT) continues to lead the market, reflecting a broader shift toward long-term investment strategies in the crypto space . This sustained momentum in ETF inflows is a strong indicator of growing institutional interest, even as Bitcoin’s price remains volatile.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

Corporate Treasuries Add to the Rally

The bullish sentiment isn’t limited to ETFs. Major corporations are also increasing their Bitcoin holdings. Japanese investment firm Metaplanet recently added 1,234 BTC to its reserves, bringing its total to 12,345 BTC. Similarly, ProCap BTC, led by Anthony Pompliano, expanded its holdings to 4,932 BTC after a fresh purchase this week. In total, corporate treasuries have added 7,597 BTC in just a few days, further supporting the upward trend.

*Metaplanet Acquires Additional 1,234 $BTC, Total Holdings Reach 12,345 BTC* pic.twitter.com/ppeGIrfVfe

— Metaplanet Inc. (@Metaplanet_JP) June 26, 2025

Regulatory Tailwinds: Crypto as Mortgage Collateral

In a significant regulatory move, the US Federal Housing Finance Agency (FHFA) has directed Fannie Mae and Freddie Mac to recognize cryptocurrency as an asset for mortgage eligibility. This policy shift could reshape the mortgage market, potentially making homeownership more accessible for crypto holders. However, market participants are watching closely for further details and regulatory clarity in the coming days.

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.

— Pulte (@pulte) June 25, 2025

SO ORDERED pic.twitter.com/Tg9ReJQXC3

Technical Outlook: Bullish Momentum Builds

Bitcoin’s technical indicators point to continued bullish momentum. The Relative Strength Index (RSI) stands at 56, above the neutral 50 mark, while the Moving Average Convergence Divergence (MACD) shows a bullish crossover. If Bitcoin maintains its current trajectory, a close above the May 22 all-time high of $111,980 could open the door to new highs, with targets as high as $120,000. On the downside, a correction could see BTC retest the 50-day Exponential Moving Average (EMA) at $103,543.

BTC/USDT daily chart

Market Context and What’s Next

The current rally is underpinned by a combination of institutional inflows, corporate treasury activity, and regulatory developments. As Bitcoin approaches its previous peak, the market is watching for signs of sustained momentum or potential corrections. For now, the trend remains positive, with both technical and fundamental factors supporting the case for further gains.